The latest change for entities reporting under International Financial Reporting Standards (“IFRS”) is now in effect, and it is redefining the way a lessee will account for lease obligations. IFRS 16 requires entities to capitalise any leases other than low-value leases, or leases that are shorter than 12 months, as a “right-of-use asset” with a corresponding credit to the liability for the lease obligation on the Statement of Financial Position. This new standard is effective for annual periods beginning on or after January 1, 2019. Furthermore, a lessee must choose either a full retrospective approach or a modified retrospective approach when transitioning to this new standard.

The accounting rules under this new standard are the result of an effort to eliminate off-balance-sheet financing by recognising the obligation in the Statement of Financial Position. Under the previous standard (IAS 17), lease costs are expensed by the lessee in a systematic manner over the term of the lease and only capitalised if the characteristics of the lease result in a transfer of substantially all the risks and rewards incidental to ownership of the leased asset. Information on the required payments under the operating lease obligation beyond the current year is currently disclosed in the notes to the financial statements and, therefore, viewed as less transparent than if the lease were recorded on the Statement of Financial Position.

The accounting rules under this new standard are the result of an effort to eliminate off-balance-sheet financing by recognising the obligation in the Statement of Financial Position. Under the previous standard (IAS 17), lease costs are expensed by the lessee in a systematic manner over the term of the lease and only capitalised if the characteristics of the lease result in a transfer of substantially all the risks and rewards incidental to ownership of the leased asset. Information on the required payments under the operating lease obligation beyond the current year is currently disclosed in the notes to the financial statements and, therefore, viewed as less transparent than if the lease were recorded on the Statement of Financial Position.

Example

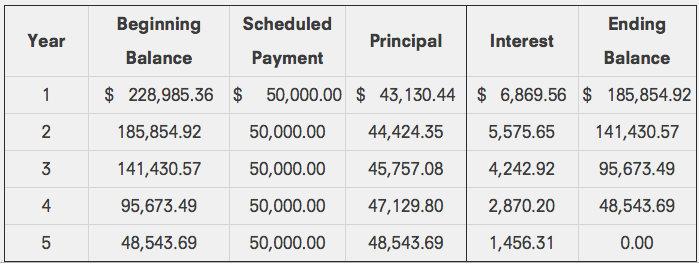

To illustrate the changes, let’s take a 5-year premises lease with rental payments of $50,000 per year and assume the company has a 3% borrowing rate on its credit facilities.

Under IAS 17: after determining that this is an operating lease, the accounting would be:

- At the commencement of the lease, there is nothing to record

- At the end of each year, there would be a rental expense recorded in the amount of $50,000

Under IFRS 16:

- At the commencement of the lease, record the present value of the lease in the Statement of Financial Position as:

- Debit: Right-of-use asset $228,985

- Credit: lease liability – current portion $ 43,130

- Credit: lease liability – long-term portion $185,855

- At the end of each year:

- record amortization of the right-of-use asset over the term of the lease. ($228,985/ 5 years).

- Debit: amortization of right-of-use asset $45,797

- Credit: Right-of-use asset $45,797

Amortization is recorded as an expense in the Statement of Earnings.- recognize the reduction in lease liability, account for interest and amount paid using the below schedule. At the end of year one, the entry would be:

- Debit: interest expense $ 6,870

- Debit: lease liability – current portion $43,130

- Credit: cash $50,000

Business Impact

This accounting change will have banks reassessing and, perhaps, redefining the financial covenants they place in their banking facilities agreements with customers that apply IFRS. A popular covenant used by banks to assess an entity’s financial position and leverage is the Debt-to-Equity ratio. The application of IFRS 16 will result in the recognition of a liability and thereby increase the “debt” component of the ratio, which will increase this ratio.

An industry group that will feel the impact of this change is investment managers that are regulated by provincial securities commissions. Depending on the category of registration, an Ontario Securities Commission (OSC) regulated entity must maintain a Minimum Working Capital (defined term) of $25,000, $50,000, or $100,000. With the application of the new standard, an entity’s working capital would be reduced by the current portion of the lease liability.

Get in touch regarding IFRS 16

The above scenarios demonstrate how the application of IFRS 16 can create challenges upon implementation. Owners are encouraged to speak to their advisors to understand the impact of this new standard on their financial reporting.